From Amazon’s growing network of stores to Gymshark’s growing portfolio of flagships stores and Warby Parker's nationwide expansion… Digital-native brands are embracing brick-and-mortar at an unprecedented pace.

This shift presents a significant opportunity for property developers and landlords who understand what these digital-first retailers require from a site. Let’s explore why this is happening and how you can capitalise on this new trend.

The digital-to-physical retail shift

We’ve been hearing about the demise of the high-street for years. Traditional stores were closing in droves and e-commerce was booming. Yet today, we’re witnessing a more nuanced evolution where the distinction between online and offline retail is blurring.

Why online-first brands are opening physical stores

Several key factors are driving this trend:

Customer acquisition costs

Digital advertising costs have risen dramatically. According to industry data, customer acquisition costs (CAC) for e-commerce brands have increased by over 60% in the past five years. Physical stores offer an alternative customer acquisition channel with different economics.

Brand differentiation

As online marketplaces become saturated, physical spaces allow brands to create distinctive experiences that can't be replicated digitally.

Omni-channel growth

Retailers have discovered that physical stores boost online sales in surrounding areas. Data from several digital-native brands shows that opening a physical location typically increases online sales by 20-35% in that region.

Case Studies: E-commerce giants going physical

Amazon

Amazon's physical retail strategy includes:

- Amazon Fresh grocery stores

- Amazon 4-Star stores featuring top-rated products

- Amazon Books locations

- Amazon Go cashier-less convenience stores

- Whole Foods Market after their 2017 acquisition

Amazon's approach demonstrates how physical retail can complement a digital ecosystem, provide convenient pickup locations, return options, and brand engagement opportunities.

Gymshark

Gymshark, a juggernaut in the fitness and overall e-commerce space, opened its first flagship store on London's Regent Street in 2022. The 18,000 sq ft space goes beyond traditional retail:

- Fitness studios hosting classes with brand ambassadors

- Personal shopping experiences

- Community events and meet-ups

- Product testing opportunities

The store has become a community hub for fitness enthusiasts, reinforcing brand loyalty while attracting new customers.

More recently Gymshark have expanded with locations in Westfield Stratford, White City, Bicester Village and even Dubai Mall.

Warby Parker

Eyewear brand Warby Parker has expanded from pure e-commerce to over 200 physical locations. This transition happened after discovering that customers who engaged with their products in person had:

- Higher conversion rates

- Larger average order values

- Stronger brand loyalty

- Lower return rates

The physical stores work in harmony with their digital presence, offering eye exams and immediate product availability while maintaining the brand's distinctive aesthetic.

How brick-and-mortar enhances customer experience

Physical retail offers a depth of customer experience that’s impossible to replicate online:

Tactile product interaction

Allowing customers to touch, try, and experience products addresses a key limitation of online shopping. For categories where tactile interaction matters like apparel, furniture, and technology, physical retail provides significant value.

Immediate gratification

Despite advances in delivery speed, nothing beats the thrill of immediate purchase offered by the in-store experience. Digital brands are leveraging this advantage by ensuring optimal inventory in physical locations.

Human connection

Well-trained staff can embody brand values and create connections that chatbots and email support cannot match. Many digital-native brands emphasize staff expertise and authentic engagement over traditional sales approaches.

The rise of experiential retail

The most innovative e-commerce brands are reimagining stores as:

Interactive showrooms

These spaces prioritise experience over inventory, featuring:

- Product demonstrations

- Interactive technology

- Customisation stations

- Limited inventory with home delivery options

Showrooms require less space for stock storage so you have more square footage for customer engagement.

Community hubs

Brands like Rapha (cycling) and Lululemon (athleisure) have created spaces where customers gather around shared interests:

- Event spaces

- Cafés and social areas

- Workshop and class spaces

- Co-working facilities

These community-focused approaches build brand loyalty beyond transactional relationships.

Brand immersion spaces

Some physical locations function as three-dimensional brand advertisements:

- Striking architectural design

- Immersive brand storytelling

- Instagram-worthy moments

- Limited-time installations and pop-ups

These spaces generate social media visibility and press coverage that extends their impact beyond immediate visitors.

What does this mean for property development?

The e-commerce to physical retail trend is creating opportunities for property developers and landlords who can meet these brands' unique requirements.

Location considerations

Digital-native brands typically prioritise:

Urban hot spots

High-visibility locations in major cities remain attractive. Particularly for flagship experiences. Brands like Glossier and Allbirds target fashion-forward districts with high foot traffic.

Strategic clustering

Many digital brands prefer locations near complementary retailers that attract similar customer demographics. This creates mutually beneficial retail ecosystems.

Data-driven selection

E-commerce retailers use customer data to select physical locations. They often choose areas with high concentrations of existing online customers. Property developers with access to demographic and footfall data have an advantage in attracting these tenants.

Space requirements

E-commerce brands typically seek:

Flexibility

Modular spaces that can be reconfigured for events, product launches, and seasonal changes.

Technology integration

Advanced infrastructure for digital integration, including:

- High-speed internet

- Digital displays

- Smart lighting systems

- Infrastructure for augmented reality experiences

Logistics considerations

Facilities for click-and-collect, returns processing, and last-mile delivery operations, often requiring back-of-house space configured differently from traditional retail.

Lease structure evolution

The digital-to-physical shift is also changing lease expectations:

Shorter terms

E-commerce brands often prefer shorter initial commitments with extension options, allowing them to test physical retail concepts before making long-term commitments.

Performance-based components

Revenue-share models that align landlord and retailer interests are increasingly popular with digital-native brands.

Pop-Up potential

Temporary spaces allow e-commerce brands to test physical retail with minimal commitment. Properties that facilitate pop-up retail attract brands at the beginning of their physical expansion.

Finding retail development opportunities

For developers looking to capitalise on this trend, several approaches can identify promising opportunities:

Data-driven site selection

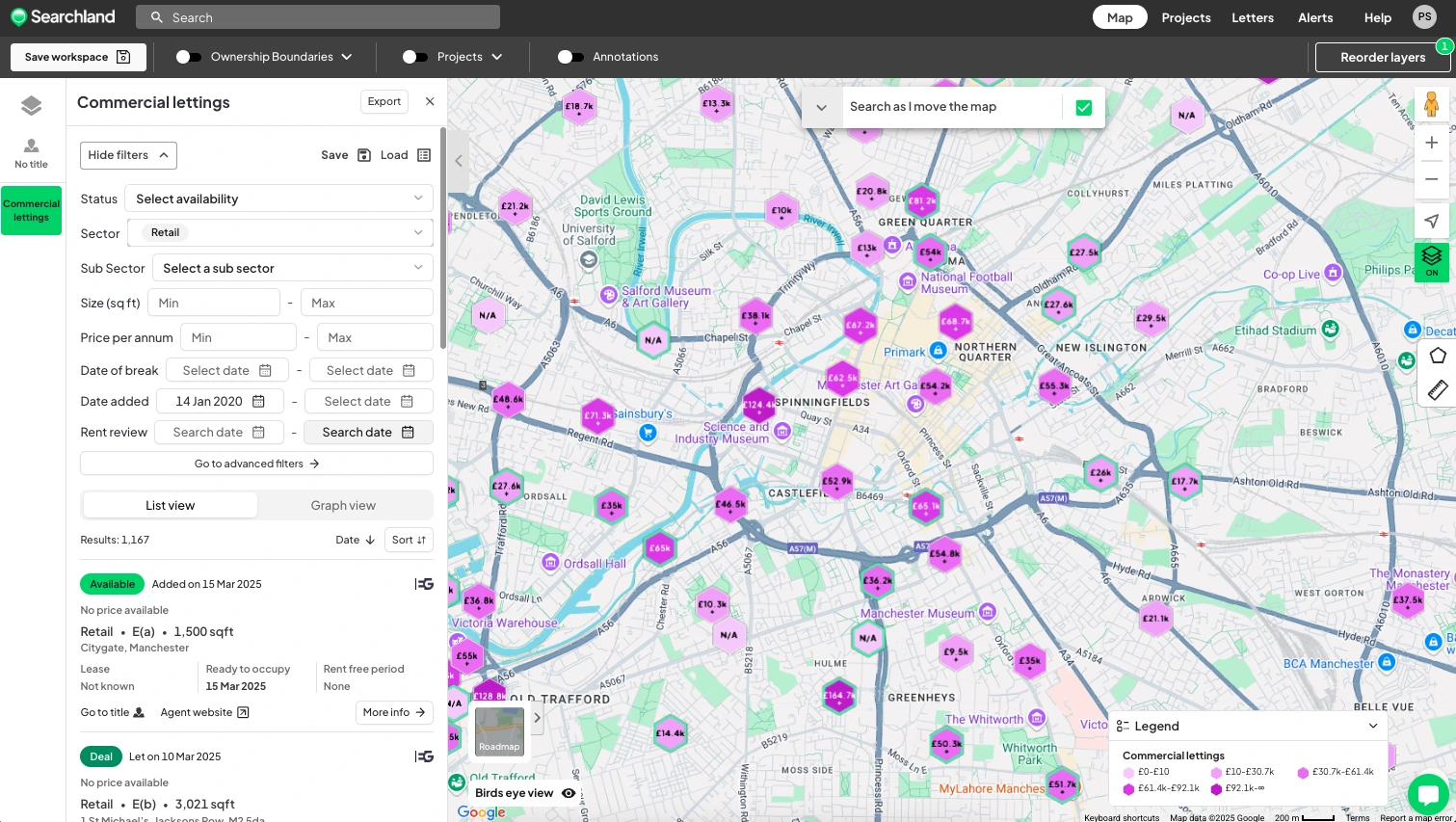

Using platforms like Searchland to analyse demographic data, transport links, and competitor locations can identify areas ripe for digital-native retail expansion.

Monitoring brand expansion plans

Following funding announcements and strategic plans from growing e-commerce brands provides early indicators of physical retail ambitions.

Repurposing existing spaces

Many department store spaces and larger retail units can be reconfigured to accommodate multiple digital-native brands, creating engaging retail destinations.

Future-proofing developments

New retail developments should incorporate the flexibility and technical infrastructure required by online brands, even if current tenants are traditional retailers. More information on sourcing prime retail sites can be found in this article.

The high-street is still struggling, but the idea of the “death of the high-street” is overblown. What we’re seeing is the evolution of the high-street. The successful retail environments of the future will blend digital convenience with compelling in-person experiences to create spaces where consumers want to spend time. These spaces will be more focused on relationships, not just transactions.

This trend represents a significant opportunity for property developers and investors. Understanding the unique requirements of online brands looking to branch into brick-and-mortar will mean big profits for those trying to capture this growing market segment.

Ready to identify prime locations for the next wave of digital-to-physical retail expansion? Book a demo with Searchland today to discover how our comprehensive property data platform can help you pinpoint ideal retail development opportunities across the UK.