If you're looking to develop elderly care facilities, you're entering one of the UK's most promising property sectors. With over 12 million people aged 65+ today, rising to 17 million by 2040, the demand for specialist later living accommodation has never been stronger.

The challenge? Finding ideal sites for elderly care isn’t like sourcing standard residential development land. It’s more complex, more nuanced, and requires sector-specific insights. In this article, we’ll show you how to identify suitable sites for care homes and later living developments - and how technology can give you a decisive edge.

Understanding the later living development landscape

Over the past two decades, the elderly care property market has transformed dramatically. Beyond traditional care homes, the sector now includes:

- Retirement villages and active later living communities

- Assisted living and extra care housing

- Specialist dementia care facilities

- Modern nursing and residential care homes

This shift is being driven by today’s retirees, who expect independence with support, vibrant communities rather than isolation, and locations that keep them connected to family and amenities. Developers who understand these evolving expectations are best placed to succeed.

Types of elderly care and later living facilities

Retirement villages and communities

These are purpose-built communities for active older people. You’ll need at least 2–5 acres, with room for phased expansion.

Ideal retirement village site features:

- Close to shops and town centres

- Strong transport connections for visitors and staff

- Space for communal facilities (restaurants, gyms, leisure spaces)

- Land flexibility for future development phases

Assisted living and extra care housing

Assisted living provides independence with light-touch care. Typical schemes need 1–3 acres for 60–80 units.

Key requirements:

- Level access across the site

- Nearby healthcare facilities

- Residential feel with discreet care infrastructure

Nursing and residential care homes

Still forming the backbone of elderly care provision, these require 0.5–2 acres depending on capacity.

Best sites prioritise:

- Quick access for emergency services

- Proximity to hospitals

- Peaceful surroundings supporting resident wellbeing

Specialist dementia care facilities

These require highly specific design considerations, usually on 1–2 acre sites.

Essential dementia care site features:

- Secure wandering gardens and outdoor therapy spaces

- Clear sightlines and calming environments

- Sensory design to minimise confusion and support wellbeing

Essential land and property requirements

Site size and configuration

- Retirement villages: 2–5+ acres

- Extra care: 1–3 acres

- Care homes: 0.5–2 acres

- Dementia facilities: 1–2 acres

Flat or gently sloping land is preferable, reducing construction costs and improving accessibility.

Location and accessibility

- Within 5 miles of hospitals or GP surgeries

- Strong transport links for staff, visitors and deliveries

- Bus stops within 400m are often a planning requirement

Planning considerations

- Correct use class (C2 vs C3) is essential for viability

- Councils often allocate elderly care sites in local plans

- Aligning with HAPPI design principles improves approval chances

Demographic analysis for site selection

Using demographic data is crucial in identifying profitable elderly care sites.

- Population age profiles: Target areas with 20%+ residents aged 65+, and consider long-term growth.

- Household wealth:

- Affluent areas suit private retirement villages

- Mixed areas work for extra care housing with varied tenure

- Moderate income areas favour local authority partnerships

- Healthcare pressures: Areas with stretched NHS resources may welcome new elderly care provision.

Using technology to find prime elderly care development sites

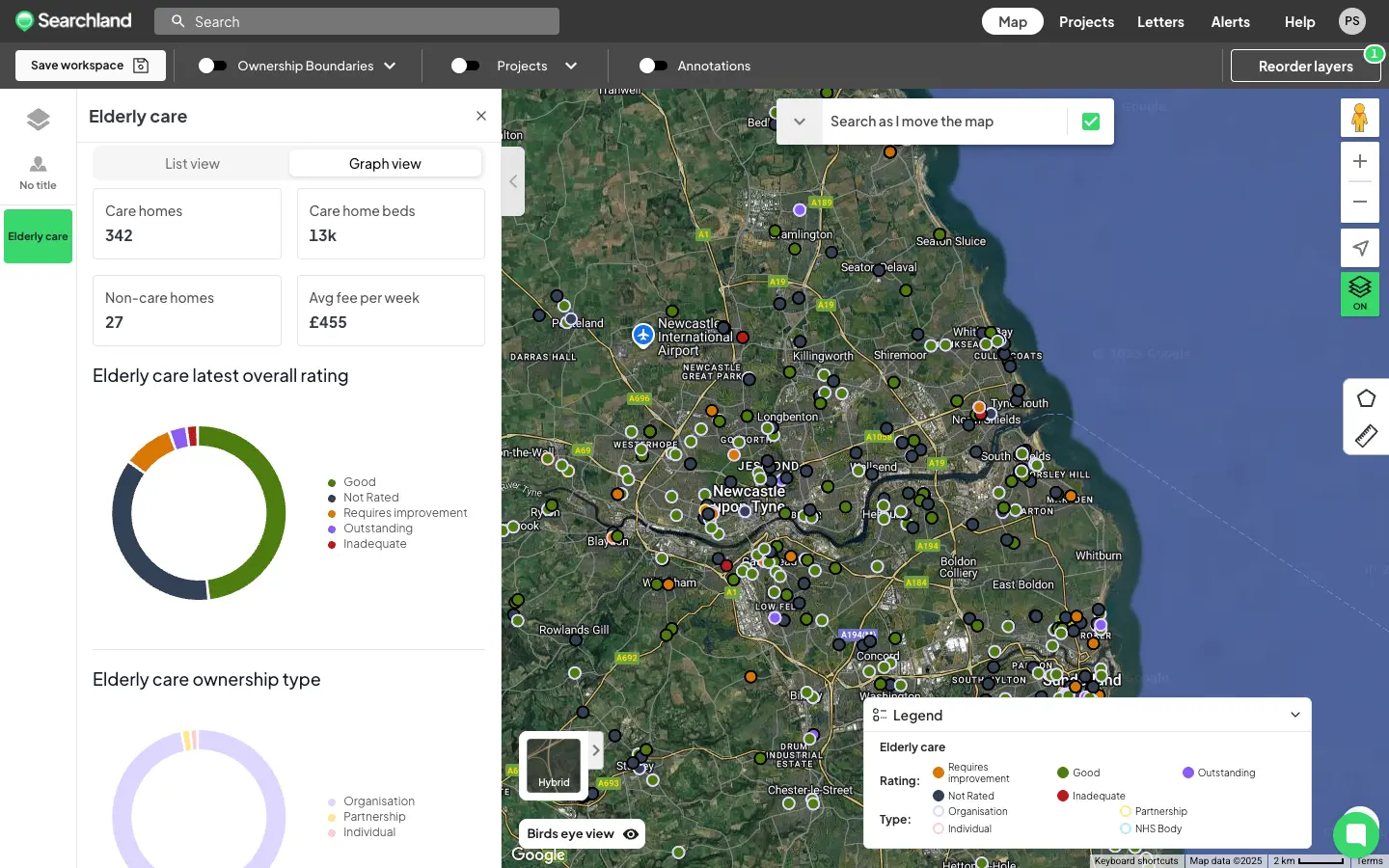

Smart developers are turning to Searchland’s Elderly Care Tool the UK’s first centralised platform mapping every CQC-registered facility.

With Searchland you can:

- Assess competition by viewing bed numbers, ratings and services

- Overlay demographic and healthcare data to pinpoint demand

- Filter by proximity to hospitals, GP surgeries and transport

- Analyse planning approvals for elderly care schemes in your target area

What once took weeks of manual research can now be done in hours - giving you a faster, data-driven way to source and secure sites.

Market opportunities and strategic considerations

The elderly care sector continues to attract institutional investment, with yields of 4.5–5.5% despite rising build costs.

Ways to strengthen your strategy:

- Partner with care operators early to improve planning outcomes and lease-up speed

- Explore regional opportunities in the Midlands and North for better land values

- Focus on developments that future-proof against demographic, technological and sustainability shifts

Future-proofing elderly care developments

Sites chosen today must perform for the next 30+ years. Key considerations include:

- Technology: Telehealth, smart homes, advanced care management systems, and full connectivity

- Sustainability: Net-zero design, renewable energy integration, biodiversity net gain

- Community integration: Developments that connect with neighbourhoods, not isolated sites

Ready to find your next elderly care development site?

The demand for elderly care facilities and later living developments is rising fast. Success depends on selecting sites that balance operational needs, planning considerations, and long-term market demand.

That’s where Searchland makes the difference. Our Elderly Care Tool, demographic analysis and planning intelligence give developers the edge in this competitive market.

Book a demo today and see how Searchland helps you find the most profitable elderly care sites - before your competitors do